SHAREHOLDERS WHO HAVE A SHARE CERTIFICATE

If you are a Celtic Plc shareholder and have not been receiving any communications from the club in respect of your shareholding there will be several possible explanations. The most common explanation in such situations is that the shareholder has failed to notify the company of a change of address.

Most Celtic shareholders acquired Ordinary Shares and Preference shares in 1994. If you have relocated since then and not notified the registrars you will be in this category. It is now 26 years since shares were offered to fans and it has become apparent the numbers of untraced shares is growing every year. This has two direct consequences:-

1. An increasing number of shareholders are unable to have a say in the management of the club affairs and

2. Preference shareholders are unable to receive their dividends.

If you notify the club of your new address you will receive the annual report and accounts and accumulated dividends that the registrars hold on your behalf.

The most common shareholding is 500 Ordinary shares and 500 Preference shares (originally 5 and 5 shares). The combined value of these shareholders is circa £1,200. The Preference shares will have paid £414 of dividends since 1997.

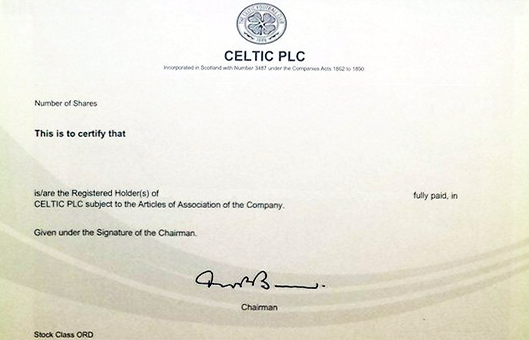

If you have your original share certificates you will be able to update your details at https://www-uk.computershare.com/Investor/default.asp. You will need your Shareholder Reference Number which is on your share certificate as shown below.

Once you have registered you can update your details online.

@TheCelticTrust

Hi there!

I have not yet received a share certificate. What do I have to do to get this dying?

Thanks a lot first!

Kind regards

Mark Hofmann

Dresden,

Germany.

Mark

We are not sure what you mean. Contact Computershare in the first instance to check but if you purchased through a stockbroker then you could email them. Your shares may be held in a Nominee Account which means you won’t get a certificate but you can instruct them to vote on your behalf each year.

Best wishes

CT

My share certificate has a certificate number and a reference number. When I try to register with computer share it asks for a ten digit shareholder reference which I don’t have. Anyone able to shed any light on this?

Raymond, you need to contact Celtic’s Registrar’s to ask for a Shareholder Registration Number (SRN) that is the number you need to register on their site.

Computershare Investor Services PLC

The Pavilions

Bridgwater Road

BRISTOL

BS99 6ZZ

United Kingdom

Call: 0370 702 0192* (Lines open between 8.30am and 5.30pm Monday to Friday)

Hi I have;

Celtic Ord 1P 2473 shares

Celtic Conv 60p 500 shares

I currently take shares as dividends via the dividend re-investment plan (drip) Do the Celtic Trust have a facility where I can allocate my voting rights to you?

We need to mobilise the silent 25% to remove this lot, they have no idea what Celtic should be about.

Peter

You can but you do it on an annual basis by proxying your vote to the Trust. It is a simple process and the forms (electronic or paper) are part of your Celtic PLC AGM pack. We also give some guidance on our website each year.

Hi I have my share certificate I used to get letters to go to the agm, I have moved house I want to change address I have shares since 1/11/1999 ordinary shares, if I try to register them it asks for a

11 digit ref mines is bigger and it won’t except it any help please thanks gerry

Gerry, can if you look at the site under Share Services you will see some advice there. If you need further help can you please email us at Trust@celtictrust.net

hi I hold my shares in Celtic with Hargreaves Lansdown but I have try TO TRANFER them to computer share but hargreaves want relice them from the nomine account what can i do to make them do it

Can you contact us by email William so we can understand the issue and help if we can.